Posts

Showing posts from February, 2012

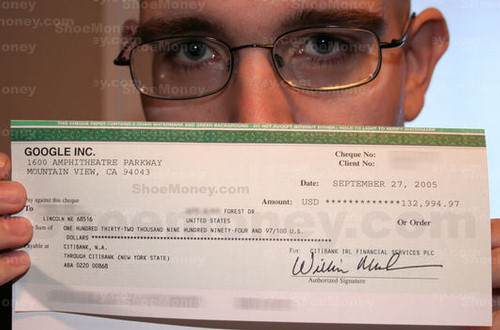

List of biggest gainers from Google Adsense

- Get link

- X

- Other Apps

stratascale "!Cloud hosting doesn’t have to suck

- Get link

- X

- Other Apps

UPDATE 2-Zynga, Hasbro partner to make toys, games

- Get link

- X

- Other Apps

Google Developing Home Entertainment System 2012

- Get link

- X

- Other Apps

FBI releases dossier on Steve Jobs 2012

- Get link

- X

- Other Apps

Twitter Later Scheduler Pro 1.0.0.0-2012

- Get link

- X

- Other Apps

ISpend (Spending Monitor) - Free for iPhone

- Get link

- X

- Other Apps

Wireless Tech Application Notes for iPhone 2012

- Get link

- X

- Other Apps

Facebook's Zuckerberg may face $2 billion tax hit 2012

- Get link

- X

- Other Apps

The iPhone is once again the world's No. 1 smartphone 2012

- Get link

- X

- Other Apps

Facebook looks to make mobile click 2012-2-7

- Get link

- X

- Other Apps

Webware application provides a free service for all owners of blogs and forums, simply publishing

- Get link

- X

- Other Apps

%E2%80%AC.jpg)

.png)